Amendments to the Planning Regulation 2017 commenced on the 4th of October, placing additional financial reporting requirements in respect of the LGIP on Queensland local governments from 1st January 2020. Integran has reviewed these changes relating specifically to infrastructure charges notices and registers in order to understand the implications upon Council’s current processes and reporting requirements.

The Key Changes summarised:

The significant new and augmented requirements of these amendments pertain to Local Government’s with an LGIP in place. Such matters include:

- Publication of an Infrastructure Charges Register (ICR) on Council’s website, including:

- The historical ICR data (as was previously required to be held by Council prior to 1st January 2020);

- The ICR requirements, as amended within the Schedule 24 definitions, must be updated monthly from 1st January 2020 (with the exception of the Infrastructure Charges Information detailed below);

- Increased functionality within the ICR (i.e. active vs static data), allowing users to search and extract data relating to a levied charge and trunk infrastructure to which it relates;

- The relevant Trunk Infrastructure Information provided by Council or donated under an infrastructure agreement or through a condition of a development approval; and

- The Trunk Infrastructure Information is to be reported either Quarterly or annually which is dependent on whether forecast value of future trunk infrastructure revenue or expenditure in a financial year exceeds $20 million (i.e. under $20M annually over $20M quarterly).

- Annually updated Infrastructure

Charges Information is to be included with the ICR, being:

- Projected infrastructure charge revenues over the forward estimates (current financial year and 3 years following);

- Projected trunk infrastructure expenditure over the forward estimates (current financial year and 3 years following);

- Information relating to the

previous financial year, including:

- Total infrastructure charges levied and collected;

- Total offsets for trunk infrastructure provided;

- Total infrastructure refunds provided by Council;

- Total infrastructure charges revenue spent by Council (on trunk infrastructure);

- Total infrastructure charges revenue not spent by Council.

- At least annual reporting of Trunk Infrastructure Information, being a list of all trunk infrastructure provided during the previous period, including such details as:

- Description of the trunk infrastructure works or land;

- How it relates to the LGIP (was it included or not, relevant LGIP ID(s) and LGIP Network);

- The constructing entity (council, developer or other public entity) and whether it was provided under an infrastructure agreement or condition of a development approval;

- The suburb or other locality in which the trunk infrastructure is situated;

- The cost of providing the trunk infrastructure; and

- If provided under a condition of approval, the development approval number.

- With respect to the amended

definition of an Infrastructure Charges Register under Schedule 24 of the

Regulations Planning, from 1st January 2020, Council’s must include

additional information relating to each ICN, including:

- The suburb or other locality in which the development is situated;

- If issued under an infrastructure agreement – the IA reference and commencement date;

- If issued as part of a development approval – the DA reference and approval date;

- If the charge has been levied via an ICN, the ICN reference and date of notice.

- Changes to what documents

Council must publish on their website:

- Clarification provided on the information

prepared or used in relation to the making, amendment or review of an LGIP, to include:

- The schedule of works model (previous requirement);

- Reviewer checklist (previous requirement);

- Appointed reviewer statement (new/clarified requirement); and

- A study report (new/clarified requirement).

- Infrastructure charges registers – both relating to the requirements prior to and post 1st January 2020;

- Infrastructure charge notices given on or after 1st January 2020 (other than an amended ICN); and

- Amended Infrastructure charges notices relating to a notice stated above (i.e. originally issued on or after 1st January 2020).

- Clarification provided on the information

prepared or used in relation to the making, amendment or review of an LGIP, to include:

So…what does this mean?

These new requirements have significant implications for local government’s internal reporting and record keeping processes (such as development approval management systems, capital works and/or long term financial forecast documents), which may not be established in a manner that facilitates simple extraction of the required information.

While Integran strongly supports the implementation of transparency measures in relation to Council’s planning, charging, and delivery of trunk infrastructure, we are concerned about the level of clarity regarding some of the new requirements and assessment triggers, and that local governments have not been provided adequate time to implement the measures, which are likely to require significant process changes across a number of internal local government systems. Key areas of concern include:

1. Under Schedule 22(3A), increased frequency of reporting requirements is triggered by:

- Estimated infrastructure charges identified in annual reporting; or

- Estimated trunk infrastructure expenditure identified in annual reporting.

Annual budgets and annual reports (as defined within the Local Government Regulation and the City of Brisbane Regulation) do not mandate local governments to report trunk infrastructure expenditure separately to non-trunk infrastructure, and therefore this aspect of the trigger may not be able to be assessed. While some Councils have adopted this as practice some will be unprepared for the change. It is also unclear whether the values associated with these trigger points are intended to include:

- The value of infrastructure charge offsets that Council has provided to developers who construct trunk infrastructure (in the revenue assessment);

- The value of trunk infrastructure that developers have provided under conditions of a development approval (in the expenditure assessment); and/or

- The value of any grants and/or subsidies that have been received and used for the construction of trunk infrastructure.

The lack of clarity around this trigger may result in inconsistent assessment and application of the requirements, as well as inconsistent reporting of data.

2. The extent of the proposed changes are likely to require significant changes to several internal Council processes, particularly for larger Council’s, including:

- The extent to which Council’s record development approval data;

- Further categorisation of capital expenditure planning and documentation;

- Information collected during on-maintenance approvals and documentation processes;

- Infrastucture charges administration and documentation; and

- Annual financial reporting, including quarterly monitoring and updates.

Integran is concerned that local governments will be unable to rapidly change these processes to incorporate the necessary detail associated with trunk infrastructure revenues and expenditure. In larger local governments, where processes are established within complex software systems and workflow processes, the timeframes provided to Council’s to implement these changes appear unreasonable.

3. Unfortunately, the amendments have not addressed several practices currently employed by a number of local governments that undermine good planning and run contrary to good governance. These include for example:

- Limiting the ability of an external party to assess the published trunk infrastructure data in detail;

- take unreasonable advantage of additional conditioning powers for development located outside of a PIA boundary; and

- failing to comply with the requirements of the Planning Act.

Integran has investigated these matters and will seek to publish these findings in due course.

4. Some other concerns of the new regulation that Integran believes should be further clarified or refined, include:

- New Section 3A (2) (d) – Requires information about the ‘trunk infrastructure to which the charge relates’ to be provided in the infrastructure charges register. It is unclear if the intention of this clause is to nominate any specific trunk infrastructure item/s within the LGIP that collected charges will fund (which could be a list of thousands of assets). The purpose of such a clause needs further investigation to establish its relevance to transparency and if worthwhile, how it could be practically achieved.

- Schedule 24 – Definitions – Infrastructure Charges Register – part (b)(ii) -further clarity is required on the term ‘subject of an IA’. Is this intended to relate to any ICN issued under a development approval that is subject to an IA, or only to charges levied solely under an IA?

- Requirement for the location (i.e. suburb) in which the levied charges or trunk infrastructure offsets relate – This requirement may pose a challenge for large developments or significant infrastructure items which may extend across multiple suburbs. A far more practical measure would be the relevant catchment which relates to the network function.

How much time do we have to get ready for these changes?

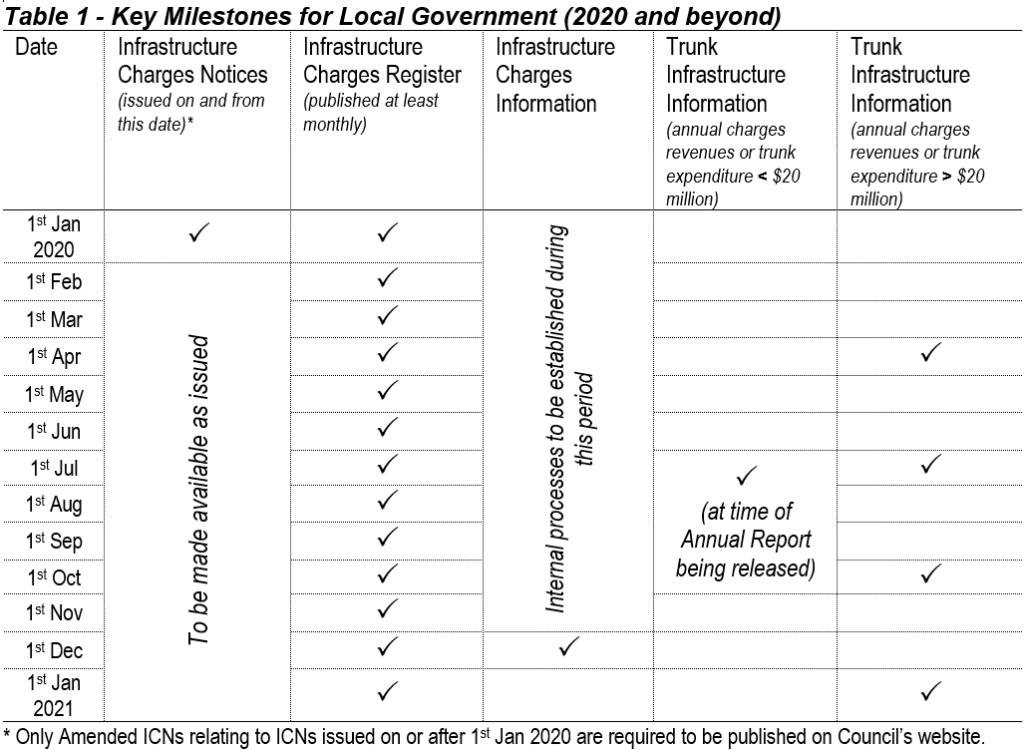

Not a great deal. The amendments put forward in the Planning (Infrastructure Charges Register and Other Matters) Amendment Regulation 2019 require Councils to act swiftly and commence on 1st January 2020. There are some requirements that Councils need to respond to quickly in order to meet the statutory timeframes, while others will require processes to be established now in order to facilitate future reporting at the latter end of 2020. The key milestones are summarised below for convenience:

We’re here to help!

Integran has been developing a range of ‘off the shelf’ registers and processes to assist Council’s in adapting to these changes quickly. Integran has extensive experience in the preparation and management of infrastructure delivery frameworks, and can provide solutions to meet your specific needs, from simple through to sophisticated, including:

- Microsoft Excel based data registers that will be compliant with the recent legislative changes, created with varying levels of automation and reporting functionality; and

- The Outvye® suite, a software package capable of managing the entire infrastructure delivery pipeline, from establishment of planning assumptions (Demand Profile), strategic planning, scenario testing, and revenue recovery (CORR module), detailed planning (CAPEX module), thought to management of conditioning, charges, and Infrastructure Agreements (Obligations Manager). Reporting out of Outvye® is fully validated based on consistent methodology necessary for good governance, evidence-based management and decision making, which seamlessly provides the necessary level of detail identified above.

Give us a call now to see how Integran can assist your Council